| ·5. | Proposal 4: To consider and vote upon a proposal to adjourn the annual meeting, if necessary or appropriate. |

| · | To transact such other business as may properly come before the annual meetingAnnual Meeting or any adjournment or postponement of the meeting. |

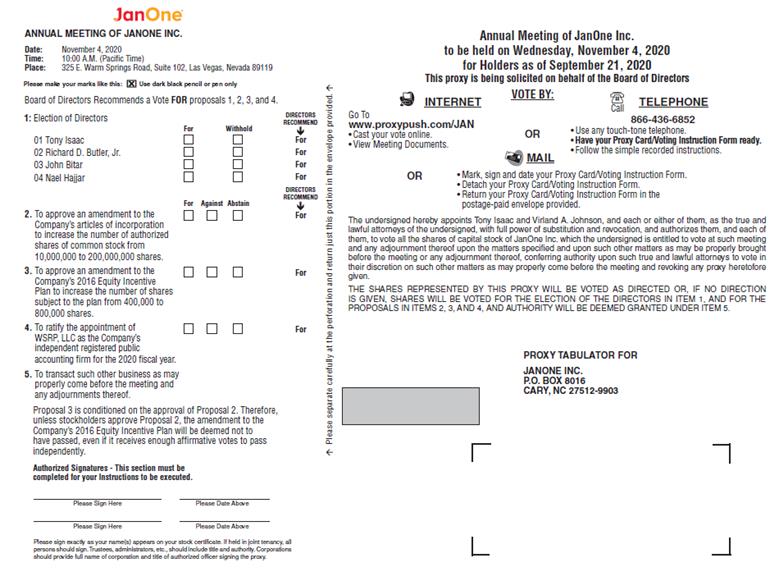

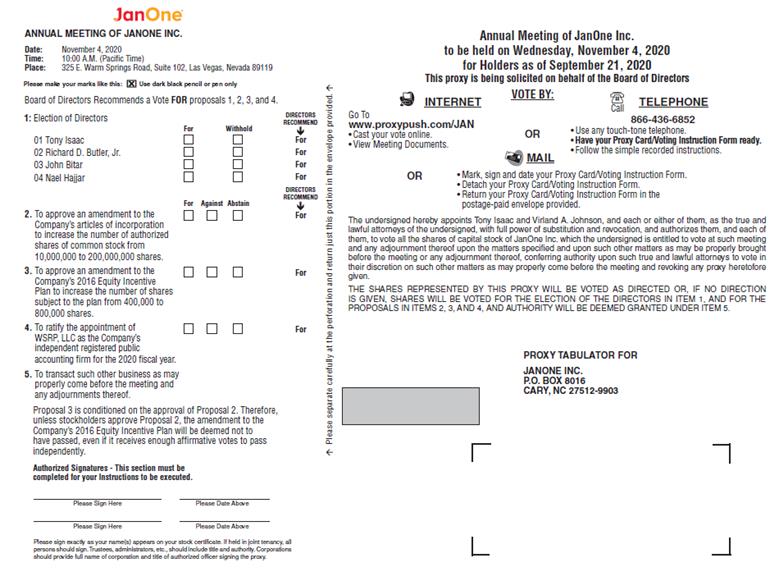

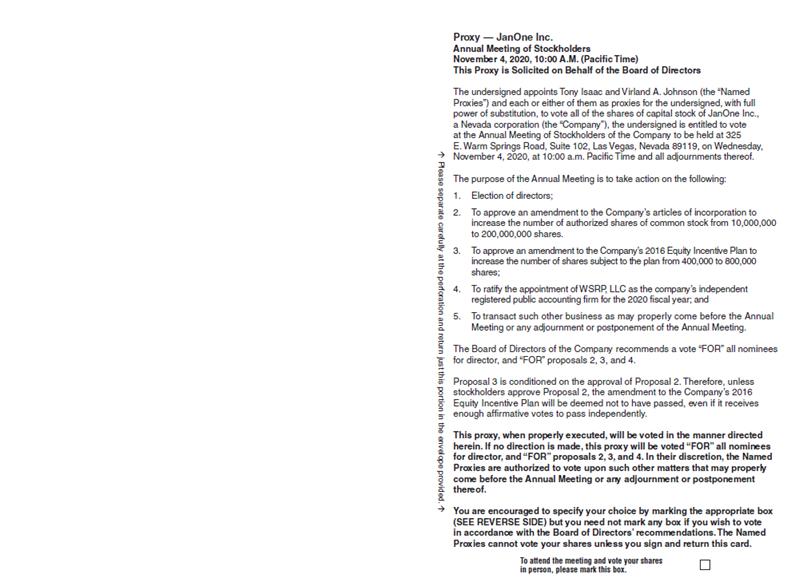

Proposal 3 is conditioned on the approval of Proposal 2. Therefore, unless the Company’s stockholders approve Proposal 2, the amendment to the 2016 Plan to increase the number of shares subject to the 2016 Plan will be deemed not to have passed, even if it receives enough affirmative votes to pass independently. Only shareholdersThe Board of record atDirectors has fixed the close of business on September 11, 2018 are entitled to notice of and to vote at21, 2020 as the annual meeting and any adjournment or postponement ofrecord date for the meeting.

Each of you is invited and urged to attend2020 Annual Meeting. Only the annual meeting in person if possible. Whether or not you are able to attend in person, you are requested to submit your proxy or voting instructions as soon as possible to ensure that your shares are voted at the annual meeting in accordance with your instructions. For instructions on voting, please refer to the Proxy Card you received in the mail.

| By Order of the Board of Directors

/s/ Michael J. Stein

Michael J. Stein, Corporate Secretary

|

September 18, 2018

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Shareholders to Be Held on Tuesday, October 23, 2018:

This Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 30, 2017, are available on the internet at:

http://proxydocs.com/ARCI

|

TABLE OF CONTENTS

APPLIANCE RECYCLING CENTERS OF AMERICA, INC.

175 Jackson Avenue North, Suite 102

Minneapolis, Minnesota 55343

PROXY STATEMENT

Solicitation of Proxies

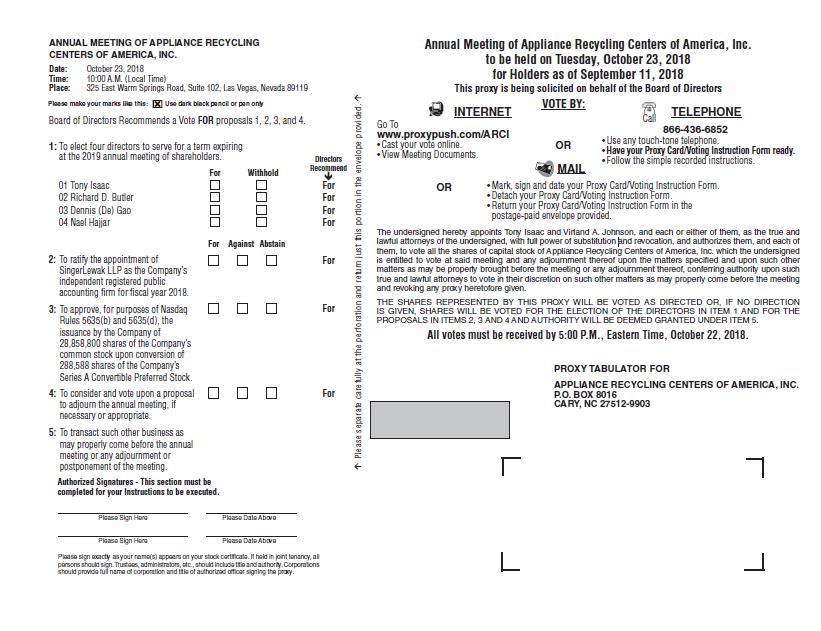

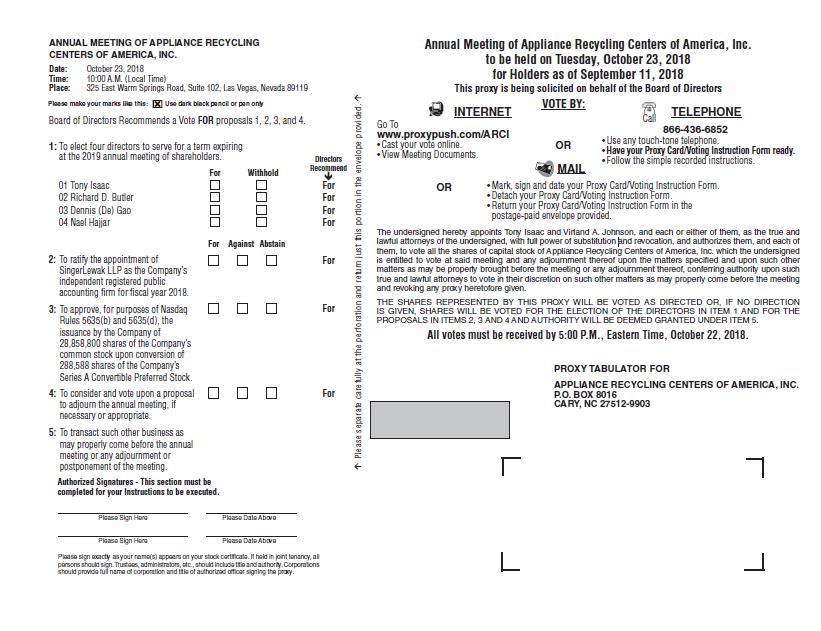

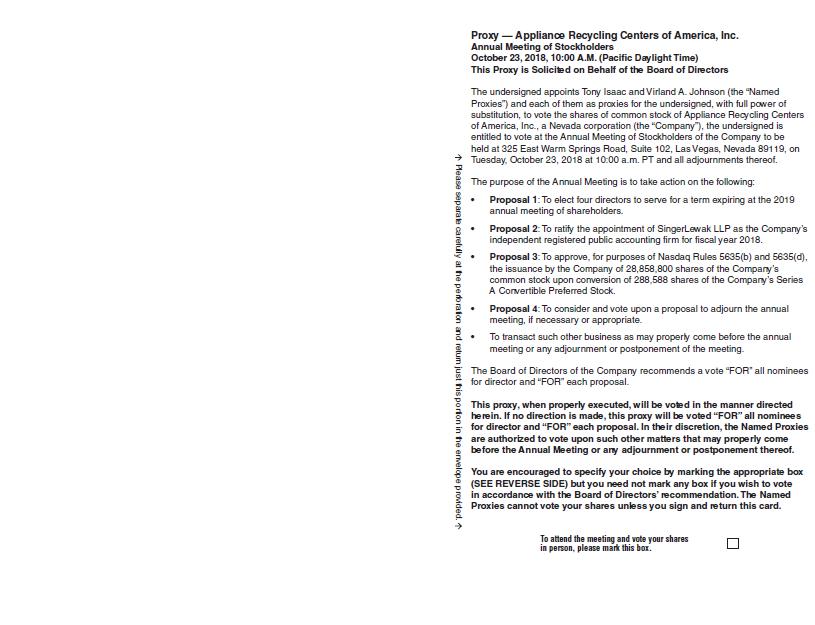

This proxy statement contains information relating to the annual meeting of shareholders of Appliance Recycling Centers of America, Inc. (the “Company”) to be held on Tuesday, October 23, 2018, beginning at 10:00 a.m., Pacific Time, at 325 East Warm Springs Road, Suite 102, Las Vegas, Nevada 89119. Your proxy is solicited on behalf of the Board of Directors of the Company for use at the 2018 annual meeting of shareholders and any adjournment or postponement of the meeting.

The approximate date on which this proxy statement and form of proxy will first be made available to shareholders is September 18, 2018.

About the Meeting

What is the purpose of the annual meeting?

At the Company’s annual meeting, shareholders will act upon the matters described in the accompanying notice of annual meeting of shareholders. This includes the election of four directors, the ratification of the appointment of our independent registered public accounting firm, and the Conversion Proposal (as defined below).

Why is stockholder approval of the issuance of shares of common stock upon conversion of the Series A Preferred Stock required?

Because our common stock is listed on the NASDAQ Capital Market, we are subject to NASDAQ Marketplace Rule 5635(b) and 5635(d), which requires stockholder approval (i) prior to the issuance of securities which would result in a change of control under Nasdaq rules and (ii) for a transaction other than a public offering that involves the sale, issuance, or potential issuance by a company of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock, or 20% or more of the voting power outstanding before the issuance for less than the greater of book or market value of the stock. The conversion of the Company’s shares of Series A Convertible Preferred Stock (the “Series A Preferred Stock”) into shares of the Company’s common stock is conditioned upon stockholder approval. Absent such condition, the issuance by the Company of 28,858,800 shares of the Company’s common stock upon conversion of 288,588 shares of the Series A Preferred Stock would exceed 20% of both the voting power and number of shares of Common Stock outstanding prior to such issuance. The book value of one share of the Company’s common stock is $2.85. Approval of the Conversion Proposal will constitute approval for purposes of NASDAQ Marketplace Rules 5635(b) and 5635(d) to the extent that the issuance of the shares of common stock may be deemed to result in a change of control of the Company and/or would be issued for less than the greater of book or market value of the Company’s stock.

Who is entitled to vote?

Only shareholdersholders of record of outstanding shares ofour common stock or Series AA-1 Convertible Preferred Stock as of the Company at the close of business on the record date September 11, 2018, are entitled to receive notice of, and to vote at, the meeting, or2020 Annual Meeting and any postponement or adjournment thereof. We have also enclosed with this notice (i) our Annual Report on Form 10-K for the fiscal year ended December 28, 2019 and (ii) a Proxy Statement.

Your vote is extremely important regardless of the number of shares you own. Whether you own a few shares or many, and whether or not you plan to attend the Annual Meeting in person, it is important that your shares be represented and voted at the meeting. Each outstanding shareYou may vote your shares on the Internet, by telephone, or by completing, signing, and promptly returning a proxy card or you may vote in person at the Annual Meeting. Voting online, by telephone, or by returning your proxy card does not deprive you of common stock entitles its holderyour right to cast one voteattend the Annual Meeting. | | By Order of the Board of Directors, | | | | | | /s/ Michael J. Stein | | | Michael J. Stein, Corporate Secretary |

The proxy statement is dated [ ], 2020 and is first being made available to stockholders on each matteror about [ ], 2020. Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be voted upon. Each outstanding share of Series A Preferred Stock entitles its holder to cast 4.5893 votes per share pursuant to the formula described in the Articles of Incorporation filed by the Company with the Nevada Secretary of Stateheld on March 12, 2018.November 4, 2020: The shares of common stockProxy Statement and Series A Preferred Stock will vote together as a single class for all proposalsAnnual Report are available at the annual meeting. The holders of outstanding common stock are entitled to a total of 8,472,651 votes, and the holders of Series A Preferred Stock are entitled to a total of 1,324,417 votes. Holders of Series A Preferred Stock are not entitled to vote on the Conversion Proposal.www.proxy.docs.com/JAN.

Who can attend the meeting?TABLE OF CONTENTS

All holders of common stock and Series A Preferred Stock as of the record date, or their duly appointed proxies, may attend the meeting.

i

JanOne Inc. 325 E. Warm Springs Road, Suite 102 Las Vegas, Nevada 89119 (800) 977-6038 PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 4, 2020 This Proxy Statement relates to the 2020 Annual Meeting of Stockholders (the “Annual Meeting”) of JanOne Inc. (“JanOne” or the “Company”). The Annual Meeting will be held on Wednesday, November 4, 2020, at 10:00 a.m. Pacific Time, at our corporate offices located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119, or at such other time and place to which the Annual Meeting may be adjourned or postponed. The enclosed proxy is solicited by the Company’s Board of Directors (the “Board”). The proxy materials relating to the Annual Meeting are first being mailed to stockholders entitled to vote at the Annual Meeting on or about [ ], 2020. References in this Proxy Statement to “2019” or “fiscal 2019” refer to the Company’s fiscal year ended December 28, 2019. QUESTIONS AND ANSWERS About the ANNUAL Meeting Q: | 1 | What is the purpose of the Annual Meeting? |

A: | At the Annual Meeting, holders of our common stock and Series A-1 Convertible Preferred Stock (the “Series A-1 Preferred Stock”) will act upon the matters outlined in the accompanying Notice of Annual Meeting and this Proxy Statement, including the (i) election of four directors to the Board, (ii) approval of an amendment to the Company’s Articles of Incorporation to increase the number of authorized shares of our common stock from 10,000,000 to 200,000,000 shares, (iii) approval of an amendment to the Company’s 2016 Equity Incentive Plan (the “2016 Plan”) to increase the number of shares subject to the 2016 Plan from 400,000 to 800,000 shares, and (iv) ratification of the appointment of WSRP, LLC as the Company’s independent registered public accounting firm for fiscal year 2020. |

Q: | What are the Board’s recommendations? |

A: | The Board recommends a vote: |

What constitutes a quorum?

The presence at the meeting, in person or by proxy,FOR election of the holdersnominated slate of a majoritydirectors;

FOR the approval of the voting poweramendment to the Company’s articles of incorporation to increase the number of authorized shares of common stock (the “Charter Amendment Proposal”); FOR the approval of the common stockamendment to the 2016 Plan (the “2016 Plan Amendment Proposal”); and Series A Preferred Stock outstanding on FOR the record date will constitute a quorum. A quorum is required for business to be conducted at the meeting. You will be considered part of the quorum if you submit a properly executed proxy card, vote your proxy by using the internet voting service or vote your proxy by using the toll-free telephone number listed on the proxy card, even if you abstain from voting. Shares held in “street name” by brokers that are voted on at least one proposal to come before the meeting will be counted as present in determining whether there is a quorum. How do I vote?

Even if you plan to attend the annual meeting you are encouraged to vote by proxy. You may vote by proxy by one of the following ways:

| 1) | By Internet: Go to www.proxypush.com/ARCI. Have your proxy card available when you access the web site. You will need the control number from your proxy card to vote. |

| 2) | By telephone: Call (866) 436-6852 toll-free (in the United States, U.S. territories and Canada) on a touch-tone telephone. Have your proxy card available when you call. You will need the control number from your proxy card to vote. |

| 3) | By mail: Complete, sign and date the proxy card, and return it in the postage paid envelope provided with the proxy material. |

If you vote by internet or telephone, your electronic vote authorizes the proxy holders in the same manner as if you signed, dated and returned your proxy card. If you vote by internet or telephone, do not return your proxy card.

If you return your signed proxy card or vote by internet or telephone but do not give specific instructions as to how you wish to vote, your shares will be votedFORall nominees in Proposal 1,FOR ratification of the Audit Committee’s appointment of ourWSRP, LLC as the Company’s independent registered public accounting firm in Proposal 2,FORfor the Conversion Proposal, andFOR the grant of authority to the Board to adjourn the annual meeting if necessary or appropriate in Proposal 4.

Can I change my vote after I return my proxy card or my internet or telephone vote?

Yes. Even after you have submitted your proxy or voted by internet or telephone, you may change your vote or revoke your proxy at any time before the proxy is exercised at the meeting. You may change or revoke it by:

| 1) | Returning a later-dated signed proxy card or re-accessing the internet voting site or telephone voting number listed on the proxy card; |

| 2) | Delivering a written notice of revocation to the Company’s Secretary at the Company’s principal executive office at 175 Jackson Avenue North, Suite 102, Minneapolis, Minnesota 55343; or |

| 3) | Attending the meeting and voting in person at the meeting (although attendance at the meeting without voting at the meeting will not, in and of itself, constitute a revocation of your proxy). |

What are the Board’s recommendations?

The Board’s recommendations are set forth after the description of each proposal in this proxy statement. In summary, the Board recommends a vote:

| · | FOR the election of each of the nominated directors.2020 fiscal year. |

| · | FOR the ratification of the appointment of our independent registered public accounting firm. | | | | | · | FOR the approval of the Conversion Proposal. |

| · | FORthe approval of the adjournment of the Annual Meeting if necessary or appropriate, including to solicit additional proxies if there are insufficient votes to constitute a quorum or to approve Proposal 3. |

If you submit your proxy card or vote by internet or telephone, unless you give other instructions on your proxy card or your internet or telephone vote, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board.

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

What voteThe 2016 Plan Amendment Proposal is required toconditioned on the approval of Charter Amendment Proposal. Therefore, unless the Company’s stockholders approve each proposal?

ForCharter Amendment Proposal, the election of directors, each shareholder of outstanding common stock and Series A Preferred Stock2016 Plan Amendment Proposal will be deemed not to have passed, even if it receives enough affirmative votes to pass independently.

Q: | Who is entitled to attend the Annual Meeting? |

A: | All holders of common stock and/or Series A-1 Preferred Stock as of the record date, September 21, 2020, or their duly appointed proxies, may attend the Annual Meeting. |

Q: | Who is entitled to vote at the Annual Meeting? |

A: | Only stockholders of record of outstanding shares of common stock and/or Series A-1 Preferred Stock of the Company at the close of business on the record date are entitled to receive notice of and to vote at the Annual Meeting, or any postponement or adjournment of the Annual Meeting. Each outstanding share of common stock entitles its holder to cast one vote on each matter to be voted upon. Each outstanding share of Series A-1 Preferred Stock entitles its holder to cast 17 votes per share on each matter to be voted upon, pursuant to the formula described in the Certificate of Designation of the Preferences, Rights, and Limitations of the Series A-1 Convertible Preferred Stock of JanOne (in its former name of Appliance Recycling Centers of America, Inc.) filed by the Company with the Nevada Secretary of State on June 21, 2019. The shares of common stock and Series A-1 Preferred Stock will vote together as a single class for all proposals at the Annual Meeting. The holders of outstanding common stock are entitled to a total of [ ] votes. The holders of Series A-1 Preferred Stock are entitled to a total of [ ] votes. As of the date of this Proxy Statement, no holder of Series A-1 Preferred Stock has converted his or its shares of Series A-1 Preferred Stock into shares of the Company’s common stock. |

Q: | What constitutes a quorum? |

A: | The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the voting power of the common stock and Series A-1 Preferred Stock outstanding on the record date will constitute a quorum. A quorum is required for business to be conducted at the Annual Meeting. You will be considered part of the quorum if you submit a properly executed proxy card, vote your proxy by using the internet voting service, or vote your proxy by using the toll-free telephone number listed on the proxy card, even if you abstain from voting. Shares held in “street name” by brokers that are voted on at least one proposal to come before the Annual Meeting will be counted as present in determining whether there is a quorum. |

Q: | How do I vote my shares if they are registered directly in my name? |

A: | We offer four methods for you to vote your shares at the Annual Meeting. While we offer four methods, we encourage you to vote through the Internet or by telephone, as they are the most cost-effective methods for the Company. We also recommend that you vote as soon as possible, even if you are planning to attend the Annual Meeting, so that the vote count will not be delayed. Both the Internet and the telephone provide convenient, cost-effective alternatives to returning your proxy card by mail. There is no charge to vote your shares via the Internet, though you may incur costs associated with electronic access, such as usage charges from Internet access providers. If you choose to vote your shares through the Internet or by telephone, there is no need for you to mail your proxy card. |

You may (i) vote in person at the Annual Meeting or (ii) authorize the persons named as proxies on the enclosed proxy card, Tony Isaac and Virland A. Johnson, to vote your shares by voting through the Internet or by telephone or by returning the enclosed proxy card by mail. By Internet: Go to www.proxydocs.com/JAN. Have your proxy card available when you access the web site. You will need the control number from your proxy card to vote. By telephone: Call (866) 436-6852 toll-free (in the United States, U.S. territories and Canada) on a touch-tone telephone. Have your proxy card available when you call. You will need the control number from your proxy card to vote. By mail: Complete, sign and date the proxy card, and return it in the postage paid envelope provided with the proxy material. Q: | How do I vote my shares of common stock if they are held in the name of my broker (street name)? |

A: | If your shares of common stock are held by your broker, bank or other nominee, or its agent (“Broker”) in “street name,” you will receive a voting instruction form from your Broker asking you how your shares should be voted. You should contact your Broker with questions about how to provide or revoke your instructions. Holders of shares of Series A-1 Preferred Stock will receive the Proxy Materials directly from the Company’s Secretary. |

If you hold your shares in “street name” and do not provide specific voting instructions to your Broker, a “broker non-vote” will result with respect to Proposals 1, 2, and 3. Therefore, it is very important to respond to your Broker’s request for four nominees. A nomineevoting instructions on a timely basis if you want your shares held in “street name” to be represented and voted at the Annual Meeting. Please see below for additional information if you hold your shares in “street name” and desire to attend the Annual Meeting and vote your shares in person. Q: | What if I vote and change my mind? |

A: | If you are a stockholder and do not hold your shares in “street name,” you may change your vote or revoke your proxy at any time before the proxy is exercised at the Annual Meeting. You may change or revoke it by: |

Returning a later-dated signed proxy card or re-accessing the Internet voting site or telephone voting number listed on the proxy card; Delivering a written notice of revocation to the Company’s Secretary at the Company’s principal executive office at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119; or Attending the meeting and voting in person at the meeting (although attendance at the meeting without voting at the meeting will be electednot, in and of itself, constitute a revocation of your proxy). If you hold your shares in “street name,” refer to the voting instructing form provided by your Broker for more information about what to do if you submit voting instructions and then change your mind in advance of the nominee receivesAnnual Meeting. Q: | How can I get more information about attending the Annual Meeting and voting in person? |

A: | The Annual Meeting will be held on Wednesday, November 4, 2020, at 10:00 a.m., Pacific Time, at our principal executive offices located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119, or such other time and place to which the Annual Meeting may be adjourned or postponed. For additional details about the Annual Meeting, including directions to the Annual Meeting and information about how you may vote in person if you so desire, please contact the Company’s Secretary at (702) 997-5968. |

Q: | What vote is required to approve each item? |

A: | Election of Directors. Election of a director requires the affirmative vote of the holders of a plurality of the shares for which votes are cast at a meeting at which a quorum is present. The four persons receiving the greatest number of votes will be elected as directors. Stockholders may not cumulate votes in the election of directors. |

Amendment to the Company’s Articles of Incorporation. Approval of the Charter Amendment Proposal equires the affirmative vote of the majority vote of the number of shares entitled to vote and represented at the meetingAnnual Meeting, present in person or by proxy, in favor of the proposal. Vote to Approve Amendment to the Company’s 2106 Equity Incentive Plan. Approval of the 2016 Plan Amendment Proposal requires the affirmative vote of the majority of the number of shares entitled to vote and represented at which a quorum is present. There is no cumulative votingthe Annual Meeting, present in person or by shareholders.proxy, in favor of the proposal. Ratification of Auditors. With respect to ratification of the appointment of our independent registered public accounting firm, approval of the Conversion Proposal, andproposal will be approved if the approval of adjournment, or any other matter that properly comes before the meeting,proposal receives the affirmative vote of the holders of a majority of the outstanding voting powernumber of shares entitled to vote and represented at the common stock and Series A Preferred Stock representedAnnual Meeting, present in person or by proxy, in favor of the proposal. The 2016 Plan Amendment Proposal is conditioned on the approval of the Charter Amendment Proposal. Therefore, unless stockholders approve the Charter Amendment Proposal, the 2016 Plan Amendment Proposal will be deemed not to have passed, even if it receives enough affirmative votes to pass independently.

Q: | Are abstentions and broker non-votes counted in the vote totals? |

A: | A broker non-vote occurs when shares held by a Broker are not voted with respect to a particular proposal because the Broker does not have discretionary authority to vote on the matter and has not received voting instructions from its clients. If your Broker holds your shares in its name and you do not instruct your Broker how to vote, your Broker will only have discretion to vote your shares on “routine” matters. Where a proposal is not “routine,” a Broker who has received no instructions from its clients does not have discretion to vote its clients’ uninstructed shares on that proposal. At the Annual Meeting, only Proposal 4 (ratifying the appointment of our independent registered public accounting firm) is considered a routine matter. Your Broker will therefore not have discretion to vote on the election of directors, the Charter Amendment Proposal, or the 2016 Plan Amendment Proposal, as these are “non-routine” matters. |

Broker non-votes and abstentions by stockholders from voting (including Brokers holding their clients’ shares of record, who cause abstentions to be recorded) will be counted towards determining whether or not a quorum is present. However, as the four nominees receiving the highest number of affirmative votes will be elected, abstentions and broker non-votes will not affect the outcome of the election of directors. With regard to the affirmative vote of the shares present at the meeting and entitled to vote on the proposal at the meeting will be required for approval. A properly executed proxy marked “ABSTAIN” with respect to any proposal will not be voted on that proposal, although it will be counted for purposes of determining the number of shares necessary for approval ofCharter Amendment Proposal and the proposal. Accordingly, an abstention2016 Plan Amendment Proposal, since they are both non-routine matters, broker non-votes and abstentions will have the effect of an “AGAINST”a vote with respect to that proposal.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respectagainst both proposals. With regard to the proposal to be acted upon. Therefore, if you do not give your broker or nominee specific instructions, your shares may not be voted on the proposal and generally will not be counted in determining the number of shares necessary for approvalaffirmative vote of the proposal.

Who will countshares present at the vote?

An Inspector of Electionsmeeting required for Proposal 4, it is a routine matter so there will be appointed forno broker non-votes, but abstentions will have the annual meeting to count the votes.

What does it mean if I receive more than one proxy card?

If your shares are registered differently and are in more than one account, you will receive more than one seteffect of proxy materials, including more than one proxy card. To ensure that all your shares are voted, sign and return all proxy cards or use the internet voting service or telephone voting service for each proxy card. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our stock transfer agent, EQ Shareowner Services (formerly Wells Fargo Shareowner Services), at 1-800-468-9716.

a vote against Proposal 4. Q: | 3 | Who will count the vote? |

A: | An Inspector of Elections will be appointed for the Annual Meeting to count the votes. |

How will voting on any other business be conducted?

Although we do not know of any business to be considered at the 2018 annual meeting other than the proposals described in this proxy statement, if any other business is presented at the annual meeting, your proxy gives authority to Tony Isaac, Chief Executive Officer, and Virland A. Johnson, Chief Financial Officer, to vote on such matters at their discretion.

When are shareholder proposals for the 2019 annual meeting of shareholders due?

To be considered for inclusion in the Company’s proxy statement for the Company’s annual meeting to be held in 2019, shareholder proposals must be received at the Company’s office no later than May 21, 2019 or, in the event the Company changes the date of its annual meeting to be held in 2019 by more than 30 days from the date of this year’s meeting, a reasonable time before the Company begins to print and send its proxy materials. Proposals must be in compliance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended, and must be submitted in writing and delivered or mailed to the Company’s Secretary, at Appliance Recycling Centers of America, Inc., 175 Jackson Avenue North, Suite 102, Minneapolis, Minnesota 55343.

Q: | Can I dissent or exercise rights of appraisal? |

A: | Under Nevada law, neither holders of our common stock nor holders of our Series A-1 Preferred Stock are entitled to dissenters’ rights in connection with any of the proposals to be presented at the Annual Meeting or to demand appraisal of their shares as a result of the approval of any of the proposals. |

Q: | How will voting on any other business be conducted? |

A: | Although we do not know of any business to be considered at the Annual Meeting other than the proposals described in this proxy statement, if any other business is presented at the Annual Meeting, your proxy gives authority to Tony Isaac, Chief Executive Officer, and Virland A. Johnson, Chief Financial Officer, to vote on such matters at their discretion. |

Q: | When are stockholder proposals for the 2021 Annual Meeting of stockholders due? |

A: | To be considered for inclusion in the Company’s proxy statement for the Company’s Annual Meeting to be held in 2021, stockholder proposals must be received at the Company’s office no later than [ ], 2020, or, in the event the Company changes the date of its Annual Meeting to be held in 2021 by more than 30 days from the date of this year’s meeting, a reasonable time before the Company begins to print and send its proxy materials. Proposals must be in compliance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and must be submitted in writing and delivered or mailed to the Company’s Secretary, at JanOne Inc., 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119. |

Under Rule 14a-4(c)(1) of the Securities Exchange Act, of 1934, as amended, any shareholderstockholder who wishes to have a proposal considered at the 2019 annual meeting2021 Annual Meeting of shareholders,stockholders, but not submitted for inclusion in the Company’s proxy statement, must set forth such proposal in writing and file it with the Secretary of the Company no later than August 4, 2019[ ], 2020, or, in the event the Company changes the date of its annual meetingAnnual Meeting to be held in 20192021 by more than 30 days from the date of this year’s meeting, a reasonable time before the Company sends its proxy materials. Failure to notify the Company by that date would allow the Company’s proxy holders to use their discretionary voting authority (to vote for or against the proposal) when the proposal is raised at the annual meetingAnnual Meeting without any discussion of the matter being included in the Company’s proxy statement. Who pays the cost of this proxy solicitation?

The expense of the solicitation of proxies for this annual meeting, including the cost of mailing, has been or will be borne by the Company. Arrangements will be made with brokerage houses and other custodian nominees and fiduciaries to send proxies and proxy materials to their principals and the Company will reimburse them for their expense in so doing. In addition to solicitation of proxies over the internet and through the mail, proxies may be solicited in person or by telephone or fax by certain of the Company’s directors, officers and regular employees, without additional compensation.

Q: | 4 | Who pays for this proxy solicitation? |

A: | The Company will bear the entire cost of this proxy solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy card, and any additional solicitation materials furnished to the stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward the solicitation material to such beneficial owners. |

Q: | Where can I access this Proxy Statement and the related materials online? |

A: | The Proxy Statement and our Annual Report to Stockholders are available at http://www.proxydocs.com/JAN. |

Ownership of Capital StockSECURITY OWNERSHIP OF CERTAIN B

Beneficial Ownership of Common Stock

ENEFICIAL OWNERS AND MANAGEMENT The following table sets forth as of September 11, 2018, the record date for the annual meeting,certain information with respect to the beneficial ownership of shares of our common stock by and Series A-1 Preferred Stock as of September 21, 2020, for: each of the Company’s directors, our named executive officers; each of the namedour current directors; all of our current executive officers and all directors and executive officers of the Company as a group, as well asgroup; and each person known to us to be the beneficial owner of more than 5% of either our common stock or Series A-1 Preferred Stock. All share information aboutin the table (including footnotes) below reflects one-for-five (1:5) reverse stock split effectuated on April 19, 2019. The business address of each beneficial ownersowner listed in the table unless otherwise noted is c/o JanOne Inc., 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119. We deem shares of 5% or more of the Company’sour common stock. Beneficial ownership includes sharesstock and Series A-1 Preferred Stock that may be acquired in the nextby an individual or group within 60 days throughof September 21, 2020 pursuant to the exercise of options or warrants.warrants or conversion of convertible securities to be outstanding for the purpose of computing the percentage ownership of such individual or group, but these shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person or group shown in the table. Percentage of ownership is based on [ shares of common stock and [ ] shares of Series A-1 Preferred Stock (which are the voting equivalent of [ ] shares of common stock) outstanding on September 21, 2020. The information as to beneficial ownership was either (i) furnished to us by or on behalf of the persons named or (ii) determined based on a review of the beneficial owners’ Schedules 13D/G and Section 16 filings with respect to our common stock and Series A-1 Preferred Stock. As of the date of this Proxy Statement, no holder of Series A-1 Preferred Stock has converted his or its shares of Series A-1 Preferred Stock into shares of the Company’s common stock. | Beneficial Owner | | Position with Company | | Number of Shares Beneficially Owned

(1) | | | Percent of Outstanding Common Stock

(2) | | | Directors and executive officers: | | | | | | | | | | | | Tony Isaac (3) | | Director, Chief Executive Officer | | | 470,000 | | | | 5.5% | | | Virland A. Johnson | | Chief Financial Officer | | | 260,000 | | | | 3.1% | | | Bradley S. Bremer (3) (4) | | Former President of ApplianceSmart, Inc. | | | 32,625 | | | | * | | | James P. Harper (5) | | Former Chief Operating Officer | | | | | | | | | | Richard D. Butler (3) | | Director | | | 90,000 | | | | 1.1% | | | Dennis (De) Gao (3) | | Director | | | 20,000 | | | | * | | | Nael Hajjar | | Director | | | – | | | | * | | | All directors and executive officers as a group (8 persons) (3) | | | | | 872,625 | | | | 10.2% | | | Other 5% shareholders: | | | | | | | | | | | | Timothy M. Matula (3) (6) | | | | | 570,000 | | | | 6.7% | | | Energy Efficiency Investments, LLC (7) | | | | | 838,793 | | | | 9.9% | | | Isaac Capital Group, LLC (8) | | | | | 1,251,993 | | | | 14.8% | | | Abacab Capital Management (9) | | | | | 439,587 | | | | 5.2% | |

| | | | | | | | Name of Beneficial Owner | | Position with Company | | Number of Shares Beneficially owned (1) | | | Percentage of Outstanding Common (2) | | Named Executive Officers and Directors: | | | �� | | | | | | | | Tony Isaac (3) | | Director, President and Chief Executive Officer | | | 94,000 | | | | 5.0 | % | Eric Bolling (4) | | Chairman, President | | | 151,607 | | | | 8.1 | % | Virland A. Johnson | | Chief Financial Officer | | | 52,000 | | | | 2.8 | % | Richard D. Butler (3) | | Director | | | 18,000 | | | * | | John Bitar (5) | | Director | | | — | | | * | | Nael Hajjar | | Director | | | — | | | * | | All directors and executive officers as a group (6 persons) | | | | | 315,607 | | | | 16.9 | % | Other 5% shareholders: | | | | | | | | | | | Timothy M. Matula (6) | | | | | 114,000 | | | | 6.1 | % | Isaac Capital Group, LLC (7) | | | | | 392,941 | | | | 21.0 | % |

_______________________

* Indicates ownership of less than 1% of the outstanding shares (1) | Unless otherwise noted, each person or group identified possesses sole voting and investment power with respect to such shares. |

(2) | Applicable percentage of ownership is based on 8,472,651[ ] shares of common stock outstanding as of September 11, 201821, 2020 plus, for each shareholder,stockholder, all shares that such shareholderstockholder could purchaseacquire within 60 days upon the exercise of existing stock options and warrants.warrants or conversion of existing convertible securities. |

(3) | Includes shares whichthat could be purchased within 60 days upon the exercise of existing stock options or warrants, as follows: Mr. Isaac, 10,000 shares; Mr. Bremer, 27,500 shares;2,000 shares and Mr. Butler, 20,000 shares;4,000 shares. |

(4) | These shares are beneficially owned by the Eric Chase Foundation, Inc. Mr. Matula, 10,000 shares; Mr.Bolling has informed the Board that he will not stand for re-election at the Annual Meeting. |

(5) | Dennis Gao 20,000 shares. The address for each individual is 175 Jackson Avenue North, Suite 102, Minneapolis, Minnesota 55343. | | | (4) | Effective October 26, 2017, the Company terminated the employment of Mr. Bremer. | | | (5) | Effective May 26, 2017, the Company terminated the employment of Mr. Harper. | | | (6) | Mr. Matula resigned from the Board of Directors effective August 10, 2018. | | | (7) | According to a Schedule 13G/AJanuary 6, 2020 and was replaced by John Bitar as disclosed in the Company’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (“SEC”)SEC on September 7, 2018, Energy Efficiency Investments, LLC (“EEI”) beneficially owns 838,793January 10, 2020. Mr. Bitar replaced Mr. Gao on the Audit Committee. |

(6) | Includes 2,000 shares of common stock. EEI has sole dispositive and voting power as to all 838,793 shares. The foregoing excludes 166,817 shares of common stock issuablethat could be purchased by Mr. Matula within 60 days upon the exercise of a commonexisting stock purchase warrant (the “Warrant”) because the Warrant contains a blocker provision under which the holder thereof does not have the right to exercise such Warrant to the extent that such exercise would result in beneficial ownership by the holder thereof, together with any of the holder’s affiliates, of more than 4.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of shares of common stock issuable upon exercise of the Warrant (the “Beneficial Ownership Limitation”). The holder is entitled to, among other things, upon notice to the Company, increase the Beneficial Ownership Limitation to 9.99% of the number of shares of the common stock outstanding immediately after giving effect to the issuance of shares of common stock upon exercise of the Warrant, with such increase to take effect 61 days after such notice is delivered to the Issuer. EEI has elected to increase the Beneficial Ownership Limitation to 9.99% and the Company has elected to waive the 61-day notice period. The address for EEI is c/o Baker & Hostetler, LLP, 600 Anton Boulevard, Suite 9000, Costa Mesa, CA 92626-7221.options. |

| | (8)(7) | According to a Schedule 13D/A13G filed with the SEC on September 11, 2018,April 30, 2019, Isaac Capital Group, LLC (“Isaac Capital”) beneficially owned 1,251,993392,941 shares of common stock. Isaac Capital has sole dispositive power as to all 1,251,993392,941 shares and sole voting power as to 1,251,993350,519 shares. The address for Isaac Capital is 3525 Del Mar Heights Road, Suite 765, San Diego, CACalifornia 92130. | (9) | According to a Schedule 13G filed March 11, 2015, Abacab Capital Management, LLC (“Abacab”) beneficially owned 439,587 shares of common stock. Abacab has sole dispositive and voting power as to all 439,587 shares. The address for Abacab is 33 W. 38th Street, New York, NY 10018. |

Beneficial Ownership of Series AA-1 Preferred Stock

The following table sets forth as of September 11, 2018, the record date for the annual meeting, the beneficial ownership of Series A Preferred Stock by each owner of 5% or more of the Company’s Series A Preferred Stock. No officers or directors of the Company have beneficial ownership of Series A Preferred Stock. Beneficial ownership includes shares that may be acquired in the next 60 days through the exercise of options or warrants.

| Beneficial Owner | | Number of Shares Beneficially Owned (1) | | | Percent of Outstanding

Series A Preferred (2) | | | Gregg Sullivan (3) | | | 57,718 | | | | 20.0% | | | Juan Yunis (4) | | | 216,729 | | | | 75.1% | | | Isaac Capital Group, LLC (5) | | | 14,141 | | | | 4.9% | |

_________________

| | | | Name of Beneficial Owner | | Number of Shares Beneficially owned (1) | | | Percentage of Outstanding Series A-1 Preferred (2) | | Isaac Capital Group, LLC (3) | | | 14,141 | | | | 5.44 | % | Gregg Sullivan (4) | | | 28,859 | | | | 11.11 | % | Juan Yunis (5) | | | 216,729 | | | | 83.44 | % |

(1) | Unless otherwise noted, each person or group identified possesses sole voting and investment power with respect to such shares. |

(2) | Applicable percentage of ownership is based on 288,588259,729 shares of Series AA-1 Preferred Stock outstanding as of September 11, 2018 plus, for each shareholder, all21, 2020. As of the date of this Proxy Statement, no holder of Series A-1 Preferred Stock has converted his or its shares that such shareholder could purchase within 60 days uponof Series A-1 Preferred Stock into shares of the exercise of existing stock options and warrants.Company’s common stock. |

(3) | The business address for Mr. Sullivan is c/o Appliance Recycling Centers of America, Inc., 175 Jackson Avenue North, Suite 102, Minneapolis, Minnesota 55343. |

(4) | The business address for Mr. Yunis is c/o Appliance Recycling Centers of America, Inc., 175 Jackson Avenue North, Suite 102, Minneapolis, Minnesota 55343. |

(5) | The address for Isaac Capital is 3525 Del Mar Heights Road, Suite 765, San Diego, CACalifornia 92130. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s officers and directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership on Form 3 and changes in ownership on Form 4 or Form 5 with the SEC. Such officers, directors and 10% shareholders are also required by SEC rules to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of copies of such forms received by it, or written representations from certain reporting persons, the Company believes that, during the fiscal year ended December 30, 2017, its officers, directors and 10% shareholders timely complied with all Section 16(a) filing requirements, except as follows: Mr. Butler filed a late Form 4 on October 12, 2017, reporting the acquisition of 20,000 shares of the Company’s common stock.

(4) | The last known address for Mr. Sullivan is 4565 Dean Martin Drive, #106, Las Vegas, Nevada 89103. On January 16, 2019, GeoTraq terminated the employment of Mr. Sullivan pursuant to the terms of the employment agreement dated August 18, 2017 (the “Sullivan Employment Agreement”) between GeoTraq and Mr. Sullivan. Under the terms of the Sullivan Employment Agreement, 28,859 of the shares of the Company’s Series A Preferred Stock owned by Mr. Sullivan immediately prior to the termination are deemed to have been returned to the Company’s treasury for cancellation effective as of January 16, 2019, without the requirement that either Mr. Sullivan or the Company take any further action. The remaining 28,859 shares of Series A-1 Preferred Stock owned by Mr. Sullivan may not be sold or otherwise transferred by him until January 17, 2020. An equivalent number of shares of Series A Preferred Stock were exchanged by the Company for such shares of Series A-1 Preferred Stock on June 19, 2019, in conjunction with an exchange by the Company for each holder of shares of Series A Preferred Stock as of such date. |

(5) | According to a Schedule 13D filed with the SEC on April 12, 2019, Juan Yunis beneficially owns 216,729 shares of Series A-1 Preferred Stock. Mr. Yunis has sole dispositive and voting power as to all 216,729 shares of Series A-1 Preferred Stock. The address for Mr. Yunis is Carrera 44B # 96 - 67 Torre 1 Apto 1103, Barranquilla, Atlantico, 08002, Colombia. |

Proposal 1:

Election of Directors

(proposal No. 1) General Information

The property, affairs, and business of the Company are managed under the direction of the Board of Directors. A board of four directors is to be elected at the meeting.Annual Meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them for management’sthe Board’s four nominees. The term of office for each person elected as a director will continue until the next annual meetingAnnual Meeting of shareholdersstockholders and until a successor has been elected and qualified, or until such director is removed or resigns. All of the nominees named below are presently directors of the Company and have served continuously since the year indicated. All nominees have indicated a willingness to serve if elected. The Company knows of no arrangements or understandings between a nominee and any other person pursuant to which the nominee has been selected as a director. All shares represented by proxies that have been properly executed and returned or properly voted using the internet or telephone voting service will be voted for the election of all of the nominees named below, unless other instructions are indicated thereon. In the event any one or more of such nominees should for any reason not be able to serve as a director, the proxies will be voted for such other person or persons as may be designated by the Board. The Board recommends a vote FOR allvoting “FOR” the election of each of the nominees. Director nominees as directors, each of whom shall hold office for a term of one year, expiring at the Annual Meeting in 2021, and until his successor is elected and qualified, or until his earlier death, resignation, or removal. Nominees for Election to the Board The names of the nominees are set forth in the table below. Following the table is certain information for at least the last five years regarding each nominee. | Name | | Position with Company | | Director Since | | Age | | | Position with Company | | Director Since | | Age (as of November 1, 2020) | | | Tony Isaac | | Director and Chief Executive Officer | | | 2015 | | | | 64 | | | Director, President and Chief Executive Officer | | 2015 | | | 66 | | | Richard D. Butler | | Director | | | 2015 | | | 69 | | | Director | | 2015 | | | 72 | | | Dennis (De) Gao | | Director | | | 2015 | | | 38 | | | | Nael Hajjar | | Director | | | 2018 | | | 34 | | | Director | | 2018 | | | 36 | | John Bitar | | | Director | | 2020 | | | 47 | |

Tony Isaachas been a director of the Company since May 2015 and Chief Executive Officer of the Company since May 2016. He served as Interim Chief Executive Officer of the Company from February 2016 until May 2016. Mr. Isaac has served as Financial Planning and Strategist/Economist of Live Ventures Incorporated (NASDAQ:(“Live Ventures”) (Nasdaq: LIVE), a holding company providing specialized online marketing solutions to small-to-medium sized local business that boost customer awareness and merchant visibility,for diversified businesses, since July 2012. He is the Chairman and Co-Founder of Isaac Organization, a privately held investment company. Mr. Isaac has invested in various companies, both private and public from 1980 to present. Mr. Isaac’s specialty is negotiation and problem-solving of complex real estate and business transactions. Mr. Isaac has served as a director of Live Ventures Incorporated since December 2011. On December 9, 2019, ApplianceSmart, Inc. (“ApplianceSmart”), a subsidiary of Live Ventures, filed a voluntary petition in the United States Bankruptcy Court for the Southern District of New York seeking relief under Chapter 11 of Title 11 of the United States Code. Mr. Isaac graduated from Ottawa University in 1981, where he majored in Commerce and Business Administration and Economics. We believe that Mr. Isaac has significant investment and financial expertise and public board experience that he brings to the Board. Richard D. Butler, Jr. has been a director of the Company since May 2015. Mr. Butler is the owner of an advisory firm whichthat provides real estate, corporate, and financial advisory services since 1999, and is the co-Founder, Managing Director, and, since 2005, a major shareholderstockholder of Ref-Razzer Company, a whistle manufacturing and vending company, since 2005.company. Prior to this, Mr. Butler was the Co-Founder and Executive Vice President of Aspen Healthcare, Inc. from 1996 to 1999. From 1993 to 1996, Mr. Butler was a Managing Director at Landmark Financial and from 1989 to 1993 he was a Partner at Cal Ventures Real Estate Investment Group. Prior to this, Mr. Butler has also served as the President and Chief Executive Officer of Mt. Whitney Savings Bank, Chief Executive Officer of First Federal Mortgage Bank, Chief Executive Officer of Trafalgar Mortgage, and Executive Officer and Member of the President’s Advisory Committee at State Savings & Loan

Association (peak assets $14 billion) and American Savings & Loan Association (NYSE: FCA; peak assets $34 billion). Mr. Butler has served on the board of directors of Live Ventures Incorporated (NASDAQ:(Nasdaq: LIVE), since August 2006 (including YP.com from 2006 to 2007). 2006. On December 9, 2019, ApplianceSmart, a subsidiary of Live Ventures, filed a voluntary petition in the United States Bankruptcy Court for the Southern District of New York seeking relief under Chapter 11 of Title 11 of the United States Code. Mr. Butler attended Bowling Green University in Ohio, San Joaquin Delta College in California, and Southern Oregon State College. We believe that Mr. Butler brings to the Board extensive experience in financial management and executive roles, which enable him to provide important expertise in financial, operating and strategic matters that impact our Company. Dennis (De) GaoJohn Bitar has been a director of the Company since May 2015.January 2020. Since 2012, Mr. GaoBitar has been providing consulting services to companies and clients on business and legal strategies, management, operations, and cost controls. From 2007 to 2012, Mr. Bitar co-founded and was Managing Partner of a worker’s compensation law firm. Mr. Bitar has been an attorney admitted to the California State Bar since 1999. Mr. Bitar graduated from July 2010 to March 2013, served as the CFO at Oxstones Capital Management, a privately held companyUniversity of Southern California in 1996 and a social and philanthropic enterprise, serving as an idea exchange for the global community. Prior to establishing Oxstones Capital Management, from June 2008 until July 2010, Mr. Gao was a product owner at The Procter & Gamble Company for its consolidation system and was responsible for the Procter & Gamble’s financial report consolidation process. From May 2007 to May 2008, Mr. Gao was a financial analyst at the Internal Revenue Service’s CFO division. Mr. Gao has served as a director of Live Ventures Incorporated (NASDAQ: LIVE) and as a member of the Audit Committee of Live Ventures Incorporated since January 2012. Mr. Gao has a dual major Bachelor of Science degreeearned his Juris Doctorate Degree in Computer Science and Economics1999 from University of Maryland, and an M.B.A. specializing in finance and accounting from Georgetown University’s McDonoughthe Pacific, McGeorge School of Business.Law. We believe that Mr. GaoBitar has significant finance, accounting and operationalbusiness experience and brings substantial finance and accountingoperational expertise to the Board.

Nael Hajjar has been a director of the Company since August 2018. Mr. Hajjar is currently the Unit Head for the Annual Wholesale Trade Survey in Statistics Canada’s Manufacturing and Wholesale Trade Division. From March 2011 through May 2016, Mr. Hajjar was a Senior Analyst – Economist of Statistics Canada’s Producer Prices Division where he developed Canada’s first ever Investment Banking Services Price Index while leading the development of a variety of Financial Services Price Index development projects. We believe that Mr. Hajjar brings to the Board extensive experience in research and analysis of financial statistics, economics, and business practices in a variety of industries including manufacturing, logging, Wholesale Trade, and financial services. We believe that Mr. Hajjar also has extensive experience in project management, and he holds a Bachelor of Social Science, Honors in Economics (which he earned in 2006), and Bachelor of Commerce, Option in Finance (which he earned in 2008), both from the University of Ottawa. Director Independence

There are no family relationships betweenamong any of the directors or executive officers of the Company. Of the current directors, each of Mr.Messrs. Butler, Mr. Gao,Bitar, and Mr. Hajjar areis an “independent” directorsdirector, as defined under the rules of The NASDAQNasdaq Stock Market (“NASDAQ”Nasdaq”) and haveeach has been an independent directorsdirector since each joined the Board. Mr. Isaac ceased to be “independent” on February 29, 2016, when he assumed the role of Interim Chief Executive Officer for the Company. Board Leadership Structure and Role in Risk Oversight

Mr.Tony Isaac, the Company’sour President and Chief Executive Officer, also serves as Chairman of the Board. Currently, the Board does not have a memberLead Independent Director. Although the Board reserves the right to make changes in the future, it believes that the current structure, as described in this Proxy Statement, is appropriate at this time given the size and experience of the Board, as well as the background and experience of Directors. The Company has not named a lead director or Chairman. The Company believes this is appropriate for the Company at this time because of the size of the Company, the size of the Board, and Mr. Isaac’s responsibility for the day-to-day management of the Company’s business. In view of these factors, the Board of Directors believes it makes sense for Mr. Isaac to participate in the Board’s discussions of developments in the Company’s business and business strategy and its results of operations.

. It is management’s responsibility to manage risk and bring to the attention of the Board of Directors the most material risks affecting the Company. The Board of Directors, including through committees of the Board comprised solely of independent directors, regularly reviews various areas of significant risk to the Company, and advises and directs management on the scope and implementation of policies, strategic initiatives, and other actions designed to mitigate various types of risks. Specific examples of risks primarily overseen by the full Board of Directors include competition risks, industry risks, economic risks, liquidity risks, and business operations risks. The Audit Committee reviews with management and the independent auditors significant financial risk exposures and the processes management has implemented to monitor, control, and report such exposures. The Audit Committee also reviews and approves transactions with related persons. The Compensation Committee (the “Compensation Committee”) reviews and evaluates potential risks related to the attraction and retention of talent, and risks related to the design of compensation programs established by the Compensation Committee for the Company’s executive officers.

Actions and Committees of the Board of Directors

In 2017,fiscal 2019, the Board of Directors met one timetwo times and took action by unanimous written consent sixnine times. In 2017,fiscal 2019, the Board of Directors had three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. The Audit Committee met five times during 2017.fiscal 2019. The Compensation Committee did not hold a formal meetingmeet during 2017 but did take one action by unanimous written consent.fiscal 2019. The Nominating and Corporate Governance Committee did not hold a formal meeting during 2017fiscal 2019 but did take one action by unanimous written consent. The Board currently has no other standing committees and has no current plans to establish additional committees. Each person who served as a director during 2017fiscal 2019 attended allat least 75% of the meetings of the Board of Directors and of the committees on which the director served. It is the Company’s policy that all directors should attend the annual meetingAnnual Meeting of shareholders. Last year, allstockholders. Three out of thefive members of the Board of Directors who were in place at the time of last year’s annual meeting attended last year’s annual meeting of shareholders.stockholders. Audit Committee The Audit Committee of the Board of Directors is comprised entirely of non-employee directors. In fiscal 2019, the members of the Audit Committee were Mr. Gao, Mr. Butler (Chair), and Mr. Hajjar. Each of Messrs. Gao, Butler, and Hajjar was an “independent” director as defined under Nasdaq rules. The Audit Committee is responsible for selecting and approving the Company’s independent auditors, for relations with the independent auditors, for review of internal auditing functions (whether formal or informal) and internal controls, and for review of financial reporting policies to assure full disclosure of financial condition. The Audit Committee operates under a written charter adopted by the Board of Directors, which is posted on the Company’s website at www.janone.com under the caption “Investor Relations - Governance.” The Board has determined that Mr. Butler is an “audit committee financial expert” as defined in SEC rules. Mr. Gao resigned from the Board of Directors effective January 6, 2020 and was replaced by John Bitar as disclosed in the Company’s Current Report on Form 8-K filed with the SEC on January 10, 2020. Mr. Bitar replaced Mr. Gao on the Audit Committee. Compensation and Benefits Committee

The Compensation Committee of the Board of Directors is comprised entirely of non-employee directors. In fiscal 2017,2019, the members of the Compensation Committee were Mr. Gao and Mr. Butler (Chairman) and Mr. Matula (until August 10, 2018)(Chair), each of whom was also an “independent” director as defined under NASDAQNasdaq rules. The Compensation Committee is responsible for review and approval of officer salaries and other compensation and benefits programs and determination of officer bonuses. Annual compensation for the Company’s executive officers, other than the CEO, is recommended by the CEO and approved by the Compensation Committee. The annual compensation for the CEO is recommended by the Compensation Committee and formally approved by the full Board of Directors. The Compensation Committee may approve grants of equity awards under the Company’s stock compensation plans. Mr. Gao resigned from the Board of Directors effective January 6, 2020 and was replaced by John Bitar as disclosed in the Company’s Current Report on Form 8-K filed with the SEC on January 10, 2020. Following Mr. Gao’s resignation, Messrs. Butler (Chair) and Hajjar serve as the members of the Compensation Committee. In the performance of its duties, the Compensation Committee may select independent compensation consultants to advise the committee when appropriate. No compensation consultant played a role in the executive officer and director compensation for fiscal 2017.2019. In addition, the Compensation Committee may delegate authority to subcommittees where appropriate. The Compensation Committee may separately meet with management if deemed necessary and appropriate. The Compensation Committee operates under a written charter adopted by the Board of Directors in March 2011, which is posted on the Company’s website at www.arcainc.comwww.janone.com under the caption “Investors -– Corporate Governance.” Governance Committee AuditThe Nominating and Corporate Governance Committee

The Audit Committee of the Board of Directors (the “Governance Committee”) is comprised entirely of non-employee directors. In fiscal 2017,2019, the members of the AuditGovernance Committee were Mr. Gao (Chairman) and Mr. Butler, and Mr. Matula (until August 10, 2018). Mr. Hajjareach of whom was appointed as a member of the Audit Committee as of August 10, 2018. Each of Messrs. Gao, Butler, Matula, and Hajjar wasalso an “independent” director as defined under NASDAQNasdaq rules. The Auditprimary purpose of the Governance Committee is responsibleto ensure an appropriate and effective role for selectingthe Board of Directors in the governance of the Company. The principal recurring duties and approvingresponsibilities of the

Governance Committee include (i) making recommendations to the Board regarding the size and composition of the Board, (ii) identifying and recommending to the Board of Directors candidates for election as directors, (iii) reviewing the Board’s committee structure, composition and membership and recommending to the Board candidates for appointment as members of the Board’s standing committees, (iv) reviewing and recommending to the Board corporate governance policies and procedures, (v) reviewing the Company’s independent auditors,Code of Business Ethics and Conduct and compliance therewith, and (vi) ensuring that emergency succession planning occurs for relations with the independent auditors, for reviewpositions of internal auditing functions (whether formal or informal)Chief Executive Officer, other key management positions, the Board chairperson and internal controls, and for review of financial reporting policies to assure full disclosure of financial condition.Board members. The AuditGovernance Committee operates under a written charter adopted by the Board of Directors in March 2011, which is posted on the Company’s website at www.arcainc.comwww.janone.com under the caption “Investors“Investor Relations - Corporate Governance.” TheMr. Gao resigned from the Board has determined thatof Directors effective January 6, 2020 and was replaced by John Bitar as disclosed in the Company’s Current Report on Form 8-K filed with the SEC on January 10, 2020. Following Mr. Gao’s resignation, Messrs. Butler is an “audit committee financial expert”(Chair) and Bitar serve as defined in SEC rules. the members of the Governance Committee. The AuditGovernance Committee discussedwill consider director candidates recommended by stockholders. The criteria applied by the Governance Committee in the selection of director candidates is the same whether the candidate was recommended by a Board member, an executive officer, a stockholders or a third party, and accordingly, the Governance Committee has not deemed it necessary to adopt a formal policy regarding consideration of candidates recommended by stockholders. Stockholders wishing to recommend candidates for Board membership should submit the recommendations in writing to the Secretary of the Company. The Governance Committee identifies director candidates primarily by considering recommendations made by directors, management and stockholders. The Governance Committee also has the authority to retain third parties to identify and evaluate director candidates and to approve any associated fees or expenses. Board candidates are evaluated on the basis of a number of factors, including the candidate’s background, skills, judgment, diversity, experience with companies of comparable complexity and size, the interplay of the candidate’s experience with the Company’s independent auditorsexperience of other Board members, the overall scopecandidate’s independence or lack of independence, and plansthe candidate’s qualifications for their audit.committee membership. The AuditGovernance Committee meets withdoes not assign any particular weighting or priority to any of these factors and considers each director candidate in the independent auditors, with and without management present, to discuss the results of their examinations, their evaluationscontext of the Company’s internal controls and the overall qualitycurrent needs of the Company’s financial reporting.Board as a whole. Director candidates recommended by stockholders are evaluated in the same manner as candidates recommended by other persons. Review, Approval or Ratification of Transactions with Related Persons

The Audit Committee is responsible for the review and approval of all transactions in which the Company was or is to be a participant and in which any executive officer, director, or director nominee of the Company, or any immediate family member of any such person (“related persons”) has or will have a material interest. In addition, all, if any, transactions with related persons that come within the disclosures required by Item 404 of the SEC’s Regulation S-K must also be approved by the Audit Committee. The policies and procedures regarding the approval of all such transactions with related persons have been approved at a meeting of the Audit Committee and are evidenced in the corporate records of the Company. Each member of the Audit Committee is an “independent” director as defined under NASDAQNasdaq rules. Board Practice Related to Nominations of Directors

The Nominating and Corporate Governance Committee is comprised entirely of non-employee directors. In fiscal 2017, the members of the Governance Committee were Mr. Gao (Chairman), Mr. Butler and Mr. Matula (until August 10, 2018), each of whom was also an “independent” director as defined under NASDAQ rules. The primary purpose of the Nominating and Corporate Governance Committee is to ensure an appropriate and effective role for the Board of Directors in the governance of the Company. The principal recurring duties and responsibilities of the Nominating and Corporate Governance Committee include (i) making recommendations to the Board regarding the size and composition of the Board, (ii) identifying and recommending to the Board of Directors candidates for election as directors, (iii) reviewing the Board’s committee structure, composition and membership and recommending to the Board candidates for appointment as members of the Board’s standing committees, (iv) reviewing and recommending to the Board corporate governance policies and procedures, (v) reviewing the Company’s Code of Business Ethics and Conduct and compliance therewith, and (vi) ensuring that emergency succession planning occurs for the positions of Chief Executive Officer, other key management positions, the Board chairperson and Board members. The Nominating and Corporate Governance Committee operates under a written charter adopted by the Board of Directors in March 2011, which is posted on the Company’s website at www.arcainc.com under the caption “Investors - Corporate Governance.”

The Nominating and Corporate Governance Committee will consider director candidates recommended by shareholders. The criteria applied by the Nominating and Corporate Governance Committee in the selection of director candidates is the same whether the candidate was recommended by a Board member, an executive officer, a shareholder or a third party, and accordingly, the Nominating and Corporate Governance Committee has not deemed it necessary to adopt a formal policy regarding consideration of candidates recommended by shareholders. Shareholders wishing to recommend candidates for Board membership should submit the recommendations in writing to the Secretary of the Company.

The Nominating and Corporate Governance Committee identifies director candidates primarily by considering recommendations made by directors, management and shareholders. The Nominating and Corporate Governance Committee also has the authority to retain third parties to identify and evaluate director candidates and to approve any associated fees or expenses. Board candidates are evaluated on the basis of a number of factors, including the candidate’s background, skills, judgment, diversity, experience with companies of comparable complexity and size, the interplay of the candidate’s experience with the experience of other Board members, the candidate’s independence or lack of independence, and the candidate’s qualifications for committee membership. The Nominating and Corporate Governance Committee does not assign any particular weighting or priority to any of these factors and considers each director candidate in the context of the current needs of the Board as a whole. Director candidates recommended by shareholders are evaluated in the same manner as candidates recommended by other persons.

Code of Ethics

Our Audit Committee has adopted a code of ethics applicable to our directors and officers (including our Chief Executive Officer, President, and Chief Financial Officer) and other of our senior executives and employees in accordance with applicable rules and regulations of the SEC and The NASDAQ Stock Market.Nasdaq. A copy of the code of ethics may be obtained upon request, without charge, by addressing a request to Investor Relations, Appliance Recycling Centers of America,Corporate Secretary, JanOne Inc., 175 Jackson Avenue North,325 E. Warm Springs Road, Suite 102, Minneapolis, MN 55343.Las Vegas, Nevada 89119. The code of ethics is also posted on our website at www.arcainc.comwww.janone.com under “Investors —– Corporate Governance.” We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding the amendment to, or waiver from, a provision of the code of ethics by posting such information on our website at the address and location specified above and, to the extent required by the listing standards of the NASDAQNasdaq Capital Market, by filing a Current Report on Form 8-K with the SEC disclosing such information.

Board Contact Information

If you would like to contact the Board or any committee of the Board, you can send an email to board@arcainc.com,board@janone.com, or write to Appliance Recycling Centers of America,JanOne Inc., c/o Corporate Secretary, 175 Jackson Avenue North,325 E. Warm Springs Road, Suite 102, Minneapolis, Minnesota 55343.Las Vegas, Nevada 89119. All communications will be compiled by the Secretary of the Company and submitted to the Board or the applicable committee or director on a periodic basis. EXECUTIVE OFFICERS CompensationSet forth below is certain information regarding each of Non-Employee Directors

Priorour current executive officers as of September 21, 2020, other than Tony Isaac, whose biographical information is presented under “Nominees for Election to August 10, 2018, the Company used a combination of cash and share-based incentive compensation to attract and retain qualified candidates to serve on the Board of Directors. In setting director compensation,”

Virland A. Johnson, 60 | Mr. Johnson was appointed Chief Financial Officer of the Company on August 21, 2017. Mr. Johnson had previously served the Company as a consultant beginning in February 2017. Mr. Johnson also continues to serve as Chief Financial Officer for Live Ventures. On December 9, 2019, ApplianceSmart, a subsidiary of Live Ventures, filed a voluntary petition in the United States Bankruptcy Court for the Southern District of New York seeking relief under Chapter 11 of Title 11 of the United States Code. Prior to joining Live Ventures, Mr. Johnson was Sr. Director of Revenue for JDA Software from February 2010 to April 2016, where he was responsible for revenue recognition determination, sales and contract support while acting as a subject matter expert. Prior to joining JDA, Mr. Johnson provided leadership and strategic direction while serving in C-Level executive roles in public and privately held companies such as Cultural Experiences Abroad, Inc., Fender Musical Instruments Corp., Triumph Group, Inc., Unitech Industries, Inc. and Younger Brothers Group, Inc. Mr. Johnson’s more than 25 years of experience is primarily in the areas of process improvement, complex debt financings, SEC and financial reporting, turn-arounds, corporate restructuring, global finance, merger and acquisitions and returning companies to profitability and enhancing stockholder value. Mr. Johnson holds a Bachelor’s degree in Accountancy from Arizona State University which he earned in 1982. |

APPROVAL OF AN AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO INCREASE OUR AUTHORIZED COMMON STOCK (Proposal No. 2) Our Board of Directors has determined that it is in our best interest, and in the Company consideredbest interest of our stockholders, to amend our Articles of Incorporation to increase the significant amounttotal number of time that directors expend fulfilling their dutiesauthorized shares of common stock from 10,000,000 shares to 200,000,000 shares (the proposed “Charter Amendment”). If approved by our stockholders, the Company as well asCharter Amendment will become effective upon the skill level requiredfiling of the Charter Amendment with the Nevada Secretary of State, which filing is expected to occur promptly after the Annual Meeting. The text of the Charter Amendment is set forth in Appendix A, and this description of the proposed amendment to our Articles of Incorporation is qualified by the Company of membersfull text of the Board. Non-employee directorsCharter Amendment. Capitalization Our existing Articles of Incorporation authorizes up to 10,000,000 shares of common stock and 2,000,000 shares of preferred stock. We estimate that the Company received an annual feefollowing shares of $24,000common stock were issued or reserved for their servicefuture issuance as directors. The Chairperson of the Audit Committee received an additional annual feeSeptember 21, 2020: [ ] shares of $6,000. Non-employee directors also receivedcommon stock; [ ] shares of Series A-1 Convertible Preferred Stock, which convert into [ ] shares of common stock; and 400,000 shares of common stock optionsreserved for issuance under the 2016 Equity IncentivePlan, of which 0 shares remain available for further issuance as awards under the Plan. Non-employee Accordingly, at September 21, 2020, only [ ] shares of common stock remain unreserved generally and 0 shares remain available for future issuance as awards under the 2016 Plan. Reason for the Amendment We believe that the additional shares of authorized common stock are necessary to provide us with appropriate flexibility to utilize equity for business and financial purposes that the Board determines to be in the Company’s best interests on a timely basis without the expense and delay of a stockholders’ meeting. The Board believes that the remaining authorized common stock is not likely to be sufficient to permit us to respond to potential business opportunities or to pursue important objectives designed to enhance stockholder value. In addition, if the 2016 Plan Amendment Proposal is approved by the Company’s stockholders, then 400,000 additional shares of common stock will be reserved for issuance under the 2016 Plan. The additional authorized shares of common stock will provide us with flexibility to use our common stock, without further stockholder approval (except to the extent such approval may be required by law or by applicable exchange listing standards) for any proper corporate purposes, including, without limitation, raising capital through one or more future public offerings or private placements of equity securities, expanding our business or acquiring assets through future transactions, entering into strategic relationships, providing equity-based compensation and/or incentives to employees, officer or directors, often received an optioneffective stock dividends, or for other general corporate purposes. If the Charter Amendment is approved by our stockholders, the Board does not intend to purchase 10,000solicit further stockholder approval prior to the issuance of any additional shares of common stock or securities convertible into common stock, except as may be required by applicable, law, regulation, or exchange listing rules. We currently are not a party to any agreement that obligates us to issue additional shares of common stock. In addition, upon their initial appointment or election to